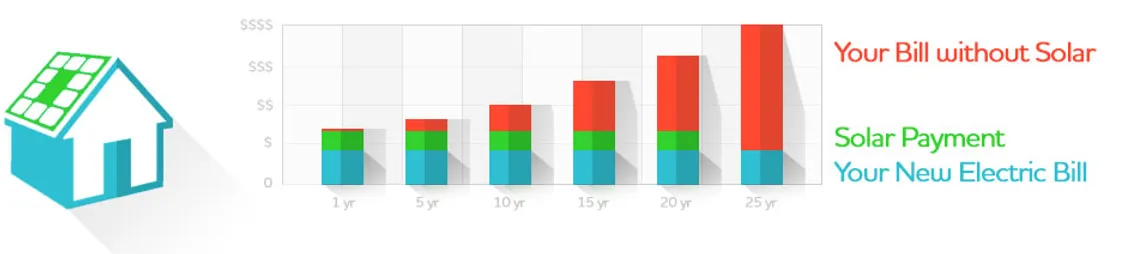

Solar remains a very smart decision with Texas Solar Power Incentives and will definitely save you money! Many of our customers see instant savings, and all see long term savings. Once your system is paid off, the solar continues to generate and you are no longer renting your energy from the power company or paying off the system cost.

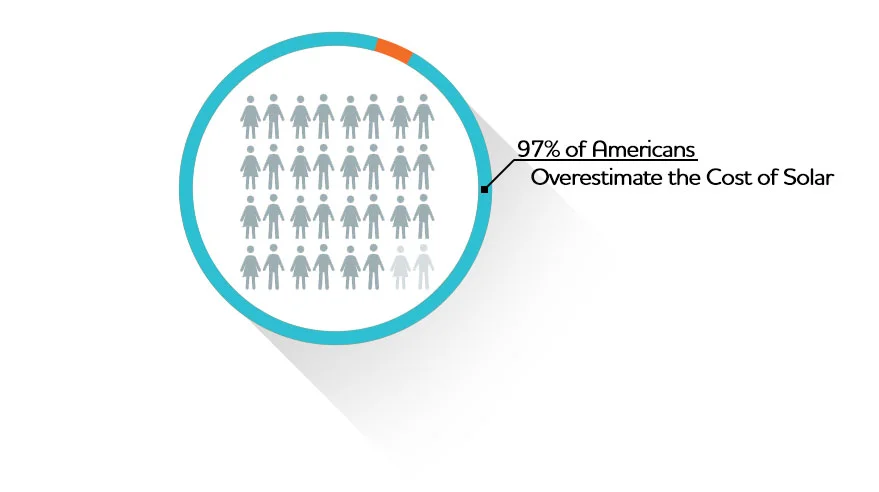

Right now, you’re renting your power from an Energy Provider. That provider is selling you power for a premium cost, and the price goes up year over year. The more power we consume as a community, the more the Energy Providers charge along with inflation the prices are soaring.

With Solar, you switch from paying for your power each month to paying for the cost of the solar system. The difference is that the Solar Power system will eventually be completely paid off and you’ll be able to generate power without any payment. It’s an amazing process with Solar Power Incentives!

The Federal Government is definitely on board with the Solar Initiative as well offering a Solar Tax Credit. It’s call the Investment Tax Credit or ITC. The ITC is a 30% Tax Credit on the total purchase price of your Solar System. For example, if you get a Solar System with a purchase price of $30,000 (No Money Down) then you’re tax credit at the end of the year would be $9,000! Yes, $9,000 just for going solar which really makes the cost of your system only $21,000. That money comes right off your taxes dollar for dollar, and if you normally get a refund, you’ll get an extra $9,000 back. This is a terrific Solar Power Incentive. Yes, it’s sound too good to be true, and there is a catch! The Solar Tax Credit only last for the next couple years, and then it will be reduced and eventually completely taken away. That’s why it’s so important to go Solar right now!

Learn More about the Tax Credit and How to File with Turbo Tax